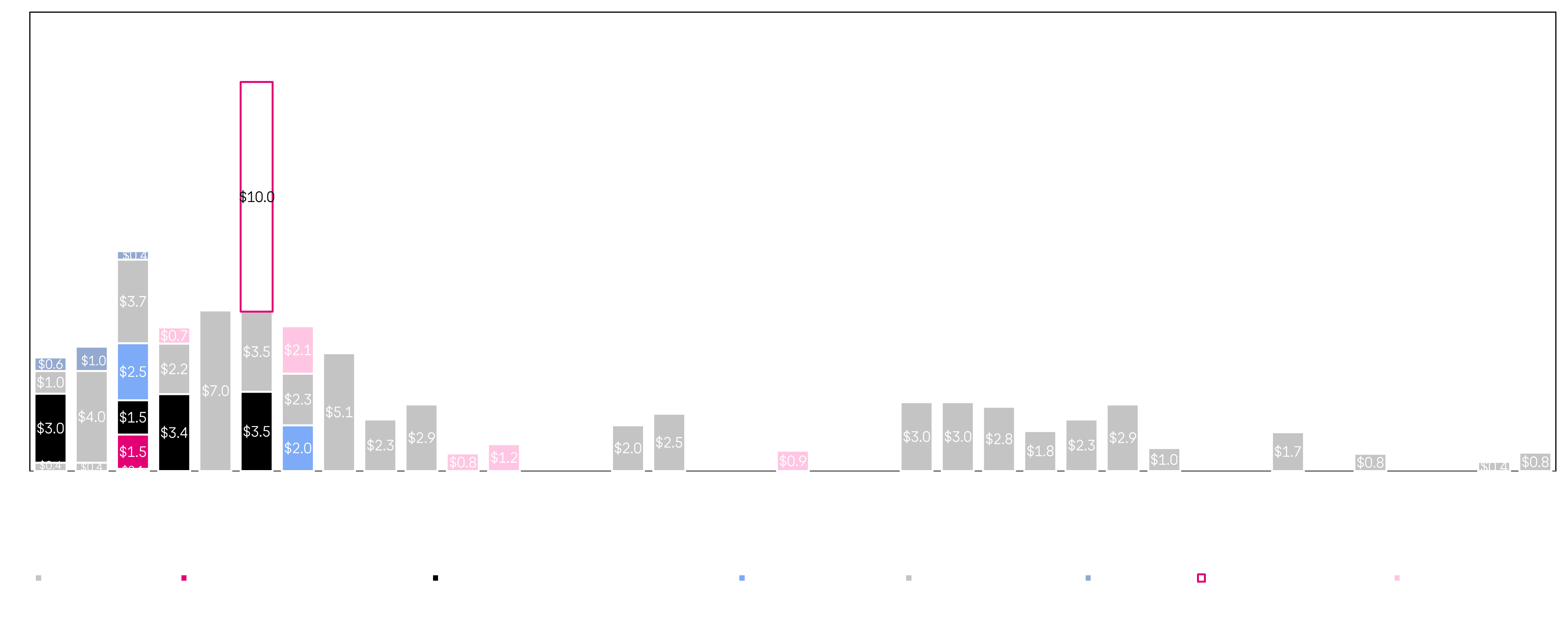

Outstanding Notes And Credit Facility

As Of December 31, 2025

Note: Total maturities include amortization of ECA Facility which are not reflected in the bars for the respective years. Does not include maturities of Tower Obligations, Capital Leases, and Other. Tranche numbers are rounded and may not add up to total.

*Includes high yield style call provision.

**Converted to U.S. dollars based on foreign exchange rate as of December 31, 2025.